A warning for the auto industry: Go digital or become a mere hardware provider

A senior German auto industry analyst warned this week that most global carmakers are not in good shape for the coming connectivity and autonomous-driving revolution.

“Very few auto manufacturers have the overall strategic and technical competence,” said Stefan Bratzel, head of Germany’s Center of Automotive Management (CAM). Without that competence, he said, they will be dependent on other technology specialists and, effectively, become mere hardware providers.

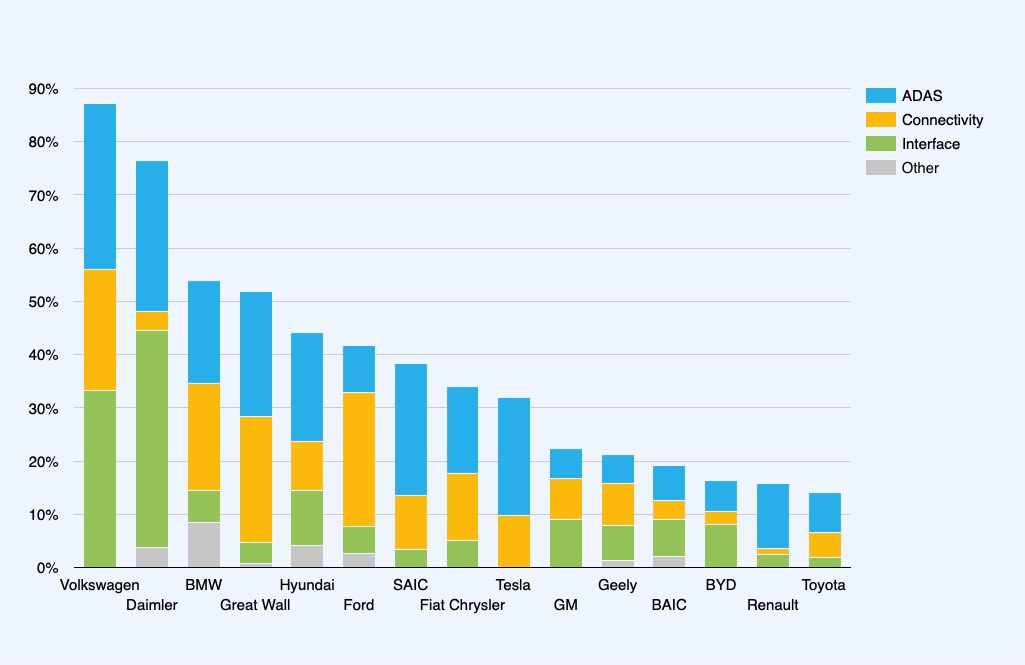

CAM, in cooperation with the automotiveIT publications, each year looks at the competitiveness of individual car manufacturers when it comes to innovation in the connected-car space.

In this year’s ranking Germany’s Volkswagen Group and premium car maker Daimler are well positioned to compete in the rapidly changing auto industry. French carmakers PSA and Renault, as well as Japan’s Toyota ranked on the lower end of the scale.

In an automotiveIT online presentation, Bratzel said auto manufacturers have to quickly acquire expertise in new, digital areas, which implies they will be forced to vertically integrate much more than they have done in recent decades. “To get control of the central value creation, much will have to be brought in-house,” he said.

Specifically with regard to autonomous-driving and connected-car technology, which in years to come will be increasingly important, the analyst said tech companies such as Alphabet and its Waymo driverless-car division, chipmaker Intel and e-commerce giant Amazon are much better positioned than traditional automakers.

Why does that matter? Because the market for in-car connected services and functions can total more than €200 billion by 2030.

Bratzel said connected add-on functions could generate between €840 and €1,020 in revenue for each car sold by 2030. He cited such functions as highway pilot, city pilot, in car e-commerce, entertainment and vehicle to grid/home energy.

For the whole auto industry that comes to between €159 billion and €234 billion in 2030. For the VW Group alone, the potential added revenue could total €29 billion.

Participants in the automotiveIT webinar were asked whether auto manufacturers or tech players will, in future, set the tone for connected mobility. Of all participants in the poll, 66% said tech players, while 34% still expressed faith in the auto industry to play the leading role.

Sajjad Khan, chief technology officer of Mercedes-Benz, expressed little concern about the outcome. Said Khan: “We are already a tech player.”