Growing questions over supply chains and just-in-time manufacturing

(April 15, 2022) The Covid-19 pandemic, the war in Ukraine and the current semiconductor shortage is forcing a rethink of long established practices in the global automotive industry. Specifically, just-in-time (JIT) manufacturing and lengthy, complex cross-border supply chains are likely to change as car manufacturers and suppliers prepared for new major shocks in the future.

“Long supply chains expose companies to vulnerabilities,” said David Bailey, professor of business economics at the UK’s Birmingham Business School. Speaking during an online discussion hosted by British car magazine Autocar, he cited as “inevitable” that car companies will, in future, acquire components and parts closer to home. Companies will also make sure they don’t rely on just one supplier for a particular part, he said.

Stephen Norman, a veteran auto industry executive and most recently head of Vauxhall Motors, agreed. “Re-shoring is massive and it will be the first time I have seen it taking place,” he said. Norman cited the semiconductor supply chain, which crosses borders multiple times, as a case in point.

David Brickhill, CEO of aftermarket provider Klarius, said Brexit has aggravated supply chain problems for companies located in the UK. “A number of challenges have gotten in the way of just-in-time and force manufacturers like us to hold more inventory.” He warned that “building high inventories comes with huge costs and ultimately affects profits.”

Birmingham Business School’s Bailey said car companies will in-source more systems to boost their self-reliance. “The balance is about to shift between make and buy,” he said. And he added that, to distribute risk more widely, there will be an increase in collaboration pacts between industry players.

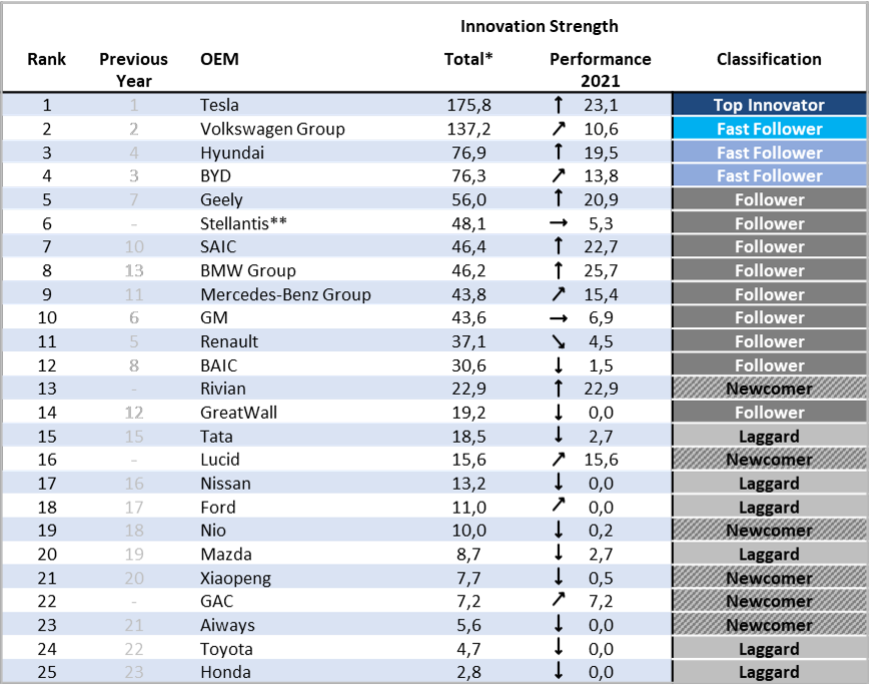

CAM sees record earnings year for global car industry

(Nov. 5, 2021) Global automakers greatly improved their nine-month pretax earnings compared with 2020 and many even matched or exceeded profits made in 2019, the year before the Corona pandemic kicked in. Car companies’ individual financial performance varies greatly, but a study by Germany’s Center of Automotive Management (CAM) predicts that 2021 will be a record earnings year, despite widespread shortages of semiconductors and raw materials. Those shortages are a major factor in automakers’ moves toward more expensive, higher margin vehicles. At the same time, CAM says, auto manufacturers’ costs are dropping because high customer demand has allowed them to greatly reduce buying incentives. “The automotive industry is currently showing contradictory trends,” says CAM director Stefan Bratzel. “On the one hand, production and sales are stagnating as a result of the chip crisis and the shortage of raw materials. On the other, manufacturers can demand high prices for their new and used cars, which for some results in double-digit profit margins.” Among major industry players, carmakers BMW, Stellantis and Tesla posted the highest profit margins in the first nine months of the year, while Volkswagen Group, Hyundai and Renault were at the lower end of the profitability scale.

IHS Markit: Chip shortage to continue in Q3

The auto industry will continue to face disruption from chip shortages in the third quarter, IHS Markit says. But the impact is likely to be less severe than earlier. “We expect an improvement from the first or second quarter because the situation is becoming better understood and great efforts are being made to enhance visibility within a very complex supply chain,” the market researchers say.